Value of advice - Your PlaybookValue of advice - Your Playbook

Financial planning is undergoing a critical transition from its roots as a product sales-based occupation to one that sells professional services and advice.

But as advisers move from price-takers to price-makers, many find they struggle to articulate their value. The good news is that of the primary elements of product, administration, and advice, the latter is the only one where margins are being maintained or in some cases increasing.

“Cost is only an issue in the absence of value”

Someone once defined a business, probably half in jest, as the process of extracting money from others without having to resort to physical violence. So we know we are going to need to do a whole lot better than that!

Start by asking yourself what industry you are in. If you think you are in product sales and distribution, you may as well pack your bags now. You are on the retirement tour, and like John Farnham, may have done one too many.

Respect where we have come from. But acknowledge where we are now. We are in the advice industry. The only way advisers will survive and thrive is to add value. I have put together a playbook for you below. I know from long experience that it works.

Two Types of Value

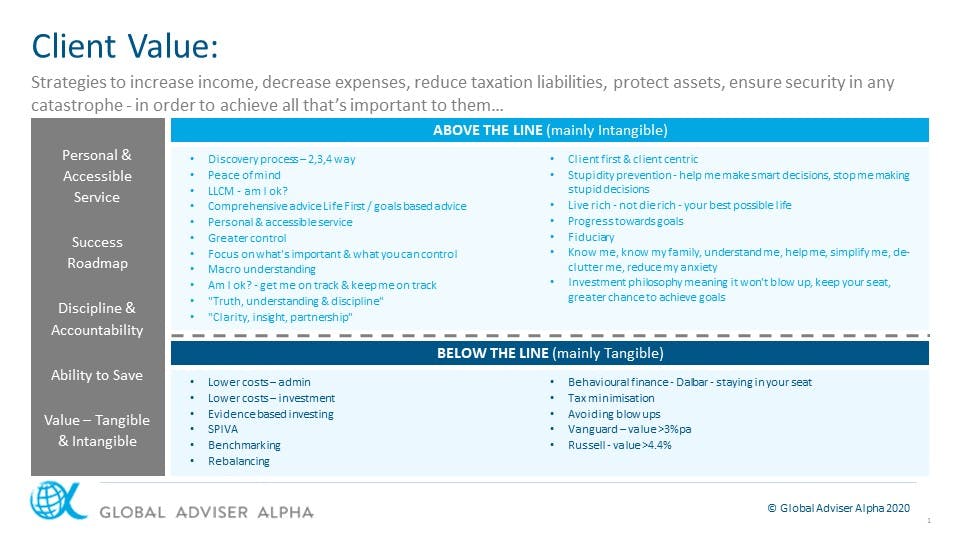

There are two types of value we need to articulate and demonstrate – tangible and intangible.

The advice proposition is moving from purely ‘below the line’ factors - talking about money, investments, risk insurance, mortgages – to ‘above the line’ - talking about the desired outcomes. In other words, the shift is from product to people and from money to meaning.

Doing business above the line helps us make better and deeper connections, add more value for clients and enable us to develop more sustainable relationships, propositions, and businesses.

Let’s Break it down:

Core to our value proposition is to help people with strategies to increase income, decrease expenses, reduce taxation liabilities, protect assets and ensure security in any catastrophe - in order to achieve all that’s important to them. Our service is personal and accessible 24/7. We offer a success road map, showing clearly where they are now, where they would like to get to, and what milestones they need to hit along the way.

Of course, many things can change in the meantime. Financially, there is the possibility of legislative change, economic upheaval, interest rate and market movements. Personally, there are the issues of health, relationships, separation and divorce, family and children, work, redundancy, risk appetite, spending habits, family deaths and inheritance. People’s financial lives and plans are never static.

Our role in all of this is to provide discipline and accountability. Think about in terms of personal fitness. People could just join a gym or start running and swimming all on their own. But inevitably they don’t stick to the program. So they hire a trainer. It’s the same in the financial world. People may have good intentions, but they need someone to keep them on track, ensure they keep saving and remain focused on the goal.

Tangible value is anything that will have a monetary impact. The simplest example would be recommending making a concessional contribution of $25k into superannuation, and achieving a tax saving of around $8000 (the difference between their top tax rate, and the super contribution tax rate). Importantly, as cost is only an issue in the absence of value, and your fees are articulated in dollars, it’s important to articulate the tangible value in dollars also.

Intangible value is still value. But it’s different. It’s harder to quantify. It’s a feeling – their feeling. The only way we can have clients determine it is by asking a question. An example would be after an estate plan has just been implemented. While no one enjoys receiving a $2,000 bill, you need to get them focused at this point on why they did it. So your question might be: “Having thought about implementing an estate plan for years, how do you feel now that it’s finally in place?”

As for the ‘below the line’ service, the value added is typically tangible. So tell them the value in dollar terms. We know that costs and taxes are critical. We can help lower administration and investments costs, and reduce taxation liabilities.

My experience in tracking clients’ net worth annually since 1995 is that many love seeing that they are getting ahead year on year, irrespective of whether this comes from their investment portfolio, property price, bank savings etc. Track it. Show them. They’ll love it.

Evidence-Based Philosophy

I also strongly recommend that you change your investment philosophy beyond ‘I reckon’ to one that can be supported by evidence. Two sources of evidence of value are the regular Standard & Poor’s Index Versus Active (SPIVA) surveys (www.spdji.com/spiva) and the DALBAR Quantitative Analysis of Investor Behaviour (QAIB, www.dalbar.com). The former shows that most fund managers struggle to add value versus appropriate benchmarks; the latter shows that most investors do even worse than that because of their own emotions.

This so-called behaviour gap is well documented. Vanguard and Russell have both published papers on value being added by advisers. Vanguard suggests it’s circa 3%pa, and Russell circa 4.4%pa. The point is both suggest a significant portion of that is below the line and behavioural.

Citing this kind of evidence not only provides peace of mind but also can help clients avoid blow-ups and keep them in their seats in volatile markets. The more they do so, the greater the chances they will achieve their goals and aspirations - which of course is why they came to you in the first place.

As an example, I had a client who in the depths of the GFC wanted to maintain his portfolio but stop his monthly dollar cost averaging. Yes, it made no sense to be reluctant to buy when markets were on sale, but even the smartest of us can be affected when there is ‘blood in the streets’. Having persuaded him to maintain his regular deposits, I put a marker in the diary. Twelve months later, I calculated he was $227,000 better off by maintaining his DCA and told him so over coffee.

Rebalancing and Benchmarking

Rebalancing is counter-intuitive. Buying losers and selling winners can be tough when emotion is involved. But enormous value can be added via this discipline. I recommend you show clients how this works in your marketing. Make it simple. Use large fonts and clear graphics. They’ll get it.

But none of this is any good if people can’t measure their progress. As an adviser, I knew intuitively that most prospective clients’ directly held portfolios were under performing but most didn’t know it. You need to be able to measure it and you need to show where they are in respect of a benchmark. Your opinion is not enough. And this was precisely my experience.

Of course, it is more complex in the real world. Many have a mix of assets – managed funds and direct equities. But with access to transactional data histories and the right benchmarking tool, it’s no problem to give them a comparison.

As an example, in the early 2000s after developing a game changing benchmarking analytical tool, we found 141 of the first 150 prospective client portfolios we measured detracted value by a staggering average 6.2%pa or $74,000 pa on an average $1.2m portfolio measured. Of the remaining nine who outperformed, it was usually due to one ‘shooting star’ stock – so purely luck and not repeatable.

Being able to show clients this comparison is a significant source of value-add and is keenly appreciated by people who typically are too busy to pay attention to these sort of details, or not able to decipher outcomes from complex portfolios.

“Investments are like golf – even the best golfers find it hard to consistently beat par- the same is true for investors”

Above the Line

Moving above the line, value generally starts to become a lot more intangible, so we must build our EQ muscles and know when to ask the right questions.

In a high-level sense, advisers act as a fiduciary sitting on the same side of the table as the clients, providing peace of mind, greater control and visibility. They offer comprehensive Life-First goals-based advice focused both on what's important and what can be controlled.

In looking for the words to encapsulate your client value proposition, road test your version against these: “Know me, know my family, understand me, help me, simplify me, de-clutter me, reduce my anxiety”. These are the best guideposts you can have.

Using this approach, you will ask such pertinent and profound questions that the discovery process will move beyond the old two-way discovery to one where the couple find out new things about each other and in many cases even about themselves. This is specially the case around deep values.

By bringing the conversation back to the macro level – ‘Am I on track to achieve my goals and aspirations? – and showing them this visually, working through their trade-offs, you will better engage more meaningfully and deeply. This is best done using a life-long cash flow modelling tool – with clients collaboratively and consultatively, not for them in page 67 of an advice document.

What you provide in this model at the client-centric level is truth, understanding, and discipline; and clarity, insight and partnership. At the investment level, you help them make smart decisions and stop them making stupid decisions about money. In this, the process is about recognising their emotions and showing them what they can and can’t control.

Again, having an evidence-based investment philosophy prevents blow-ups, keeps clients in their seats and, in the process, moves them closer to achieving their goals.

Ultimately, it’s about helping people to live rich - not die rich. And to live their best possible lives.

Words and actions are important. Customers in this approach become clients. Review meetings become regular progress meetings – looking through the windscreen rather than in the rear-view mirror. We become client-centric, not compliance-centric.

Whatever the economic environment, it is now all about delivering and demonstrating value. In good or bad times, your top 10 clients are on someone else’s top 10 prospect list. So show them. Tell them. Demonstrate it to them. People won’t know what great financial planning looks like until they experience it.

Value is the only way of the future.

Looking for next steps? How to implement?

We are pleased to advise you that The Client Centric Advice Program is now live – online.

For the first time ever we’re offering our popular signature program in a way that is unbound by location and removes the complexities of travel and time away from your home and business.

While many practices survive, they don’t thrive in the way their principals imagined when they set out. What about you?

- Poor work life balance?

- Limited Growth?

- Too little profit?

- Limited earning?

There is a better way. Is this your time to move to a more successful future?

The Program includes 14 modules, over 27 videos, over 38 global best practice templates, scripts and agendas, along with quizzes, FAQ and text. All that can be worked through and implemented at your own pace and timeline.

All for the cost of less than one new client.

Why wait? To invest in your future, the time is now.

For further information or to join, click here