The advice industry today has some major flaws. Advice businesses are overwhelmed with regulation and compliance, and many are not remotely close to enjoying why they entered the industry in the first place - to help people.

Added to that, most are not growing at a rate anywhere near what they like to be achieving, certainly for the risk and effort they undertake.

If you are questioning why you remain in the industry, or your future value proposition, read on.

The Problem

With only around 11% of Australians currently seeking financial advice, the financial advice industry needs to rapidly evolve when it comes to the proposition, quality, cost and delivery of advice. The industry must also seek to engage clients and advice seekers on a more personalised, individual and meaningful level, so the true value of advice can be recognised.

Significant changes in regulatory requirements, client expectations and an increasing number of alternatives available mean the industry must transform itself if it wants to continue, let alone grow and be perceived as relevant by future generations of clients.

Some specific challenges are:

• The industry has been people, pen and paper dependent, with limited scale. Software has not supported the advice process and if anything has detracted from it.

• Regulatory friction has been a constant as the industry has delivered predominantly product-based financial advice.

• Most of the industry technology focuses on procedural and legal based compliance, together with standardised product projections which have driven poor decision making and created friction in the adviser and client relationship.

• Adviser profit margins have been traditionally low as compliance costs have escalated, as have all other practice-related costs due to a lack of targeted technologies. This has placed significant limitations on the number of people an adviser can serve.

• How to appeal to a new generation of millennial investors who prioritise values-based investing, with a preference for a more digital interaction and service provision.

The above environmental scenario presents an opportunity for progressive advisers to forge fully compliant client-centric, technology-enabled practices which will realise sustainable profits and help them scale.

Our experiences have highlighted a considerable gap in the wealth management and retirement planning industry for a personalised yet automated system that combines values, goals, objectives and investment preferences into one client experience.

As I wrote with my co-author Barry LaValley in our book The Life-First Advisor in 2017, advisers need to move the proposition from left brain to right brain; from ‘below the line’ to ‘above the line’; from product to people, and from money to meaning.

Well something has been developed to fill this gaping gap.

The Solution

For the first time, there is a scalable solution that enables advisers to deliver on the promise of advice, by shifting the outcome from best product to best life.

Something that places client values at the heart of the experience, with a structured and robust software-supported process that radically transforms the way real advice is delivered. Anchoring the value of financial advice in meaningful long-term goals and values, rather than just numbers and decimal points.

Something that enables financial advisers to identify what really matters to both the CFO and non-CFO spouse to shape strategies, realise priorities and goals, and drive behavioural change to help their clients live extraordinary lives.

Something that de-risks compliance and delivers a measurable, memorable and repeatable advice experience through its compliant by design processes. With everything carefully mapped against the FASEA code of ethics, Know Your Customer and Best Interest Duty requirements that lets the client scope their own advice.

That something is Lumiant, a cloud-based modular client experience platform with behavioural finance at its core.

Built for advisers by advisers, the Lumiant platform has been specifically designed to help financial advisers support their clients in living their best life by uncovering what truly drives them in life.

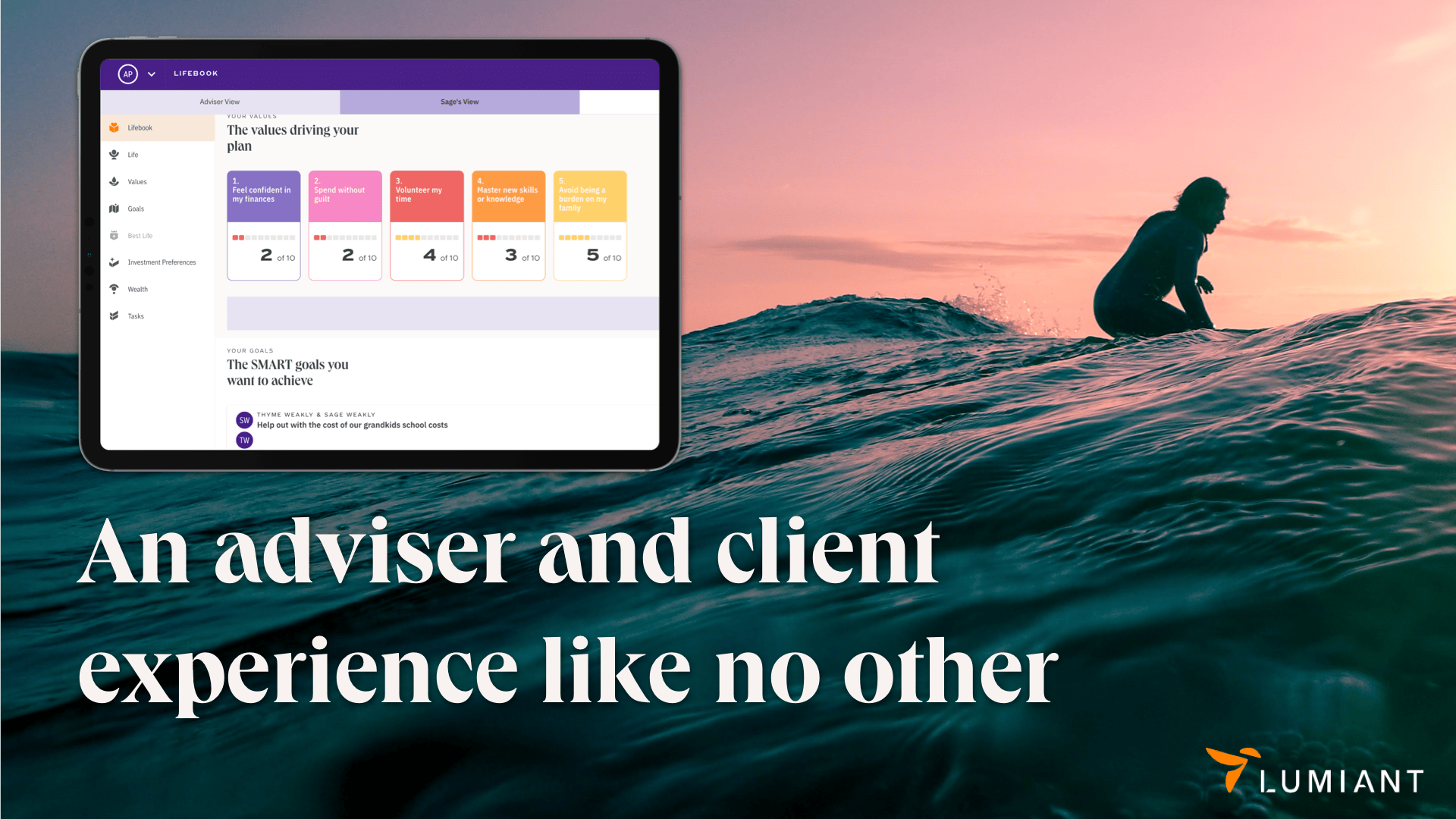

By deeply engaging with their clients using Lumiant’s proprietary software-supported process, advisers can identify the underlying motivators driving their financial decisions. Using this insight, combined with psychological and financial data inputs captured in Lumiant’s dashboards, advisers can model strategies with client values at their core. Keeping clients engaged through its Lifebook - a client portal which measures, tracks and nudges clients to achieve their financial goals and live their best life.

Through Lumiant, advisers finally have software that truly supports them in delivering on a proposition that is meaningful and will help retain clients for life. Empowering financial advisers to scale their operations and demonstrate the incredible value of advice, through its repeatable, memorable, measurable and scalable processes.

Now financial advisers have a comprehensive client-centric advice platform consisting of content, contact and task management tools, integrated client whole-of-wealth data, software supported workflows and values-based modelling tools, which generate compliant documents based on advisers’ informed strategies and recommendations.

Simply put, Lumiant is a seamless, holistic client experience management solution, driving better outcomes for both advice firms and their clients.

Lumiant has set out with an ambition to radically transform the way financial advice is delivered in Australia. It’s by no means a small target, but it is one we believe we are well on our way to achieving.

The days of pushing products are over. It’s time to serve not sell.

Do yourself and your clients a favour, take a look https://www.lumiant.com.au/ and arrange a demo.

Get on board before your competitors do. Your current and future clients will thank you for it.

Note - In 1995 the author learnt how to deliver real goals based advice by a mentor from the UK, and in 2000 learnt how to incorporate values based advice into that, by a US based mentor. The combination set him on a path to huge successes. The author is now committed to a long term mission to radically transforming the advice industry globally. To dramatically increasing the penetration of real proper advice. And to helping as many people as possible globally to live their best possible life by partnering with advisers to deliver what people really need and want.

Accordingly he is a proud ambassador for Lumiant.

“Clients win. Advisers win. We show you how.”